Bankruptcy in Ukraine: Why More People Are Filing and What It Means

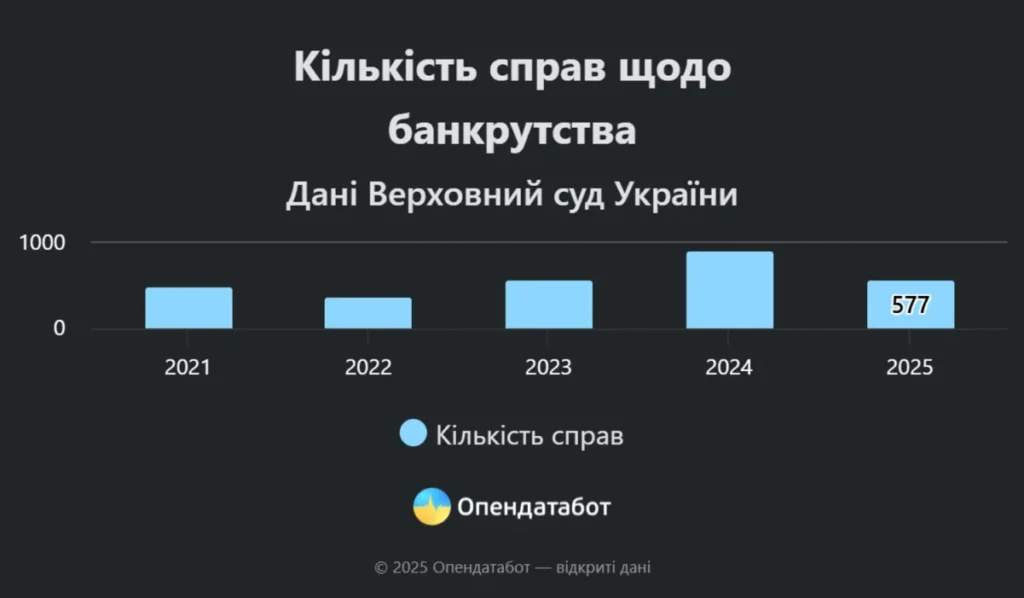

Ukraine is witnessing a steady increase in personal bankruptcy cases. According to Opendatabot and the Supreme Court, over the past five years more than 2,900 Ukrainians have been officially declared insolvent. In just the first six months of 2025, 577 people filed for bankruptcy a third more than during the same period last year.

This dynamic reflects not only economic hardship but also the gradual establishment of bankruptcy as a mechanismfor resolving debt problems.

The statistics show a relatively balanced gender distribution:

- Since 2021, 52% of applicants have been men and 48% women;

- In 2021 men dominated (57.9%), while in 2022 and 2025 women slightly outnumbered men.

According to Opendatabot, regional distribution of bankruptcies in 2025 is as follows:

- Kyiv 90 cases;

- Odesa region 47 cases;

- Kyiv region 46 cases;

- Lviv region 43;

- Vinnytsia region 41.

In Chernivtsi region, only one person has been declared bankrupt this year.

Why Bankruptcies Are Increasing

Experts explain that the rise in applications is part of a long-term trend spanning several years.

Denys Lykhopiok, lawyer, insolvency practitioner, and member of the Qualification Commission of Insolvency Practitioners, notes:

“The current increase in the number of bankruptcy cases is part of a stable trend that has been ongoing for several years. The procedure is gradually becoming more predictable: court practice is being developed, participants are gaining experience, and the mechanism itself is working more smoothly. At the same time, creditors banks and financial institutions are becoming more demanding when it comes to debt write-offs or restructuring. It is important to understand that bankruptcy is not a panacea for easy and painless ‘debt cancellation.’ The consequences of being declared insolvent will be felt for at least several years.”

Key factors behind the rise:

- Economic pressure caused by war, job losses, and declining incomes;

- Higher borrowing costs and stricter lending requirements;

- Greater public awareness of the bankruptcy procedure;

- Simplification of legal processes within the judiciary.

Procedural Challenges

Despite growing legal experience, several issues remain unresolved:

- Tax consequences after debt restructuring or write-offs;

- Interaction of insolvency cases with enforcement proceedings and other related lawsuits;

- Lack of safeguards to minimize abuse by either debtors or creditors.

It is also worth noting that bankruptcy is not a painless way out it affects credit history, access to loans, and financial services for many years.

Why This Is Happening

A combination of war-related consequences, inflation, and rising living costs is pushing many Ukrainians to seek legally secure ways to write off or restructure debts. At the same time, court practice in this area is becoming more predictable, and people are seeing bankruptcy as a legitimate way to escape the debt trap.

Expert Recommendations

- Assess the consequences before filing, consult a professional to fully understand the legal and financial risks.

- Consider restructuring sometimes negotiating a new payment plan with creditors is better than filing for bankruptcy.

- Protect both sides’ interests legislative improvements should balance the rights of debtors and creditors.

- Clarify tax implications clear rules are needed to prevent double taxation after debt cancellation.

The growth in bankruptcy cases is not just a sign of economic strain, but also an indication that Ukrainians are increasingly turning to civilised legal tools to resolve financial problems. If the state improves the legal framework and closes existing procedural gaps, bankruptcy could become a more effective tool for both citizens and creditors.